Why Paxmentis

WHY ALTERNATE INVESTMENT?

S&P 500 is benchmark for investors with its historical 9 to 11% annual return

• However, historical S&P 500 return is only achievable when investors keep money in S&P

500 without ever withdrawing

• Therefore, most investors only realize 2 to 3% annual return from S&P 500 as they tend

to buy when market is up and sell when market is down

• A complementary investment vehicle is needed to pay bills and to buy stocks when

market is down

KEY FEATURES OF GOOD ALTERNATE INVESTMENT

High enough return: meet or exceed historical S&P 500 return

• Low volatility: no extremes (high or low)

• Liquidity: money is available when needed

• Diversity: investment in multiple areas to reduce risk

• Low IncomeTax Exposure

• Low Fees

PAX MENTIS IS A UNIQUE TYPE OF ALTERNATE INVESTMENT WITH VERY DIVERSE INVESTMENT STRATEGY

• Equity Market

• Debt Instruments

• Cryptocurrency

• Real Estate

• Insurance

PAX MENTIS FUND FEATURES

Return: 25% fixed, tax-free annual return net of fees

• Volatility: no volatility as return on investment if fixed;

• Liquidity: 4 windows/year to make withdrawals

• Diversity: investment into all available instrument to adjust to changes in market

• Tax Exposure: low

• Fees: 6% fees only when making withdrawals on earnings above original investment

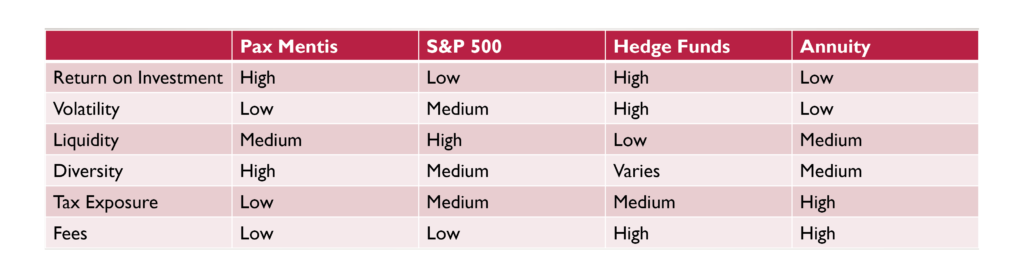

HOW PAX MENTIS FUND COMPARE WITH OTHERS

PAX MENTIS RECOMMENDS

Making S&P 500 and US Equity as primary investment

• Using Pax Mentis Fund as complementary investment

• When Market is Up

• Sell stocks to fund life

• Consider increasing investment into Pax Mentis Fund

• When Market is Down

• Make withdrawals from Pax Mentis to fund life

• Consider increasing investment into S&P 500 and US Equity Market – they are on sale!